Owning and operating a business comes with its fair share of risks and uncertainties. From unexpected accidents to natural disasters, there are numerous events that can disrupt your operations and potentially wreak havoc on your bottom line. This is where business insurance plays a crucial role in protecting your profits and ensuring the long-term success of your venture.

As a contractor or business owner, it is essential to have a comprehensive understanding of the various types of insurance coverage available to you. Contractor insurance provides a much-needed safety net for professionals in this industry, shielding them from liability claims and property damage that can arise during the course of their work. Whether you are a general contractor overseeing large construction projects or a specialized tradesperson, such as an electrician or plumber, having the right insurance coverage is vital to safeguarding your business interests.

When it comes to running a business, having a solid insurance plan in place is like having a reliable partner you can count on. A comprehensive business insurance policy provides protection against a wide range of risks, including property damage, theft, liability claims, and even loss of income due to unforeseen events. Having this coverage not only gives you peace of mind, but also serves as a protective shield, allowing you to focus on what you do best – growing your business and serving your customers.

Home insurance is equally important for business owners who operate their ventures out of their residences. This type of coverage provides a layer of protection for both your home and business, offering financial assistance in case of damage to your property or possessions. Whether you run a small online business from a spare room or have a fully equipped home office, home insurance tailored for businesses can safeguard your assets and help you bounce back from unexpected setbacks.

In this article, we will delve deeper into the world of business insurance, exploring the different types available and providing a comprehensive guide on how to select the right coverage for your specific needs. By understanding the power of business insurance and taking proactive steps to protect your profits, you can create a secure foundation for your business, ensuring its longevity and success in an ever-changing world. So, let’s embark on this journey together and unlock the secrets to safeguarding your business with the power of insurance.

1. Contractor Insurance Guide

Contractor insurance is a vital component for anyone working in the construction industry. It provides protection and peace of mind against potential risks and liabilities that may arise during the course of a project. Whether you are a small independent contractor or a larger construction firm, having the right insurance coverage is crucial to safeguarding your business and ensuring its long-term success.

Commercial Auto Insurance

One of the key aspects to consider when selecting contractor insurance is understanding the specific risks associated with your line of work. Construction projects often involve dangerous tasks and hazardous environments, making the potential for accidents or property damage higher. A comprehensive contractor insurance policy can help mitigate these risks by providing coverage for injuries, property damage, and even legal expenses that may arise from such incidents.

In addition to general liability coverage, it’s essential for contractors to consider other types of insurance that align with their specific needs. For example, builder’s risk insurance protects against damage or loss to construction projects, while surety bonds can provide financial security for clients in case of non-completion or breaches of contract. By tailoring your insurance coverage to suit the nature of your work, you can ensure that you are adequately protected in all aspects of your business operations.

Remember, investing in contractor insurance is not just about complying with legal requirements or industry standards; it’s about protecting your hard-earned profits and safeguarding the future of your business. By understanding the importance of contractor insurance and selecting the appropriate coverage, you can minimize financial risks, enhance your professional reputation, and focus on what you do best – delivering high-quality construction projects.

(Section 2 and 3 shall continue with the same format, but focus on "Business insurance guide" and "Home insurance guide" respectively.)

2. Business Insurance Guide

Business insurance is an essential aspect of protecting your company’s financial interests. Whether you are a contractor or a small business owner, having insurance coverage can provide you with peace of mind and safeguard against unexpected risks.

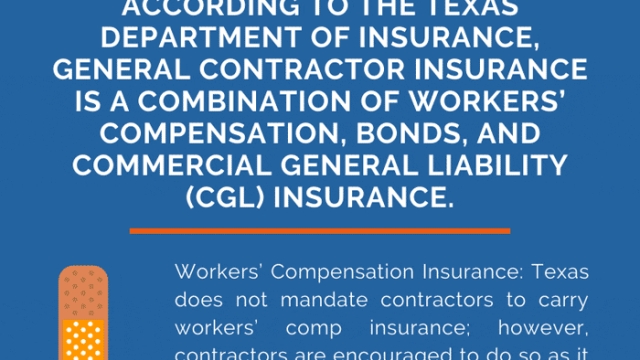

Contractor Insurance Guide: As a contractor, it is crucial to have the right insurance policies in place. This ensures that you are protected against liability claims, property damage, and potential accidents that may occur on the job site. Contractor insurance typically includes coverage for general liability, workers’ compensation, and property insurance.

Business Insurance Guide: For all types of businesses, having comprehensive insurance coverage is vital. This can include general liability insurance, which protects against third-party claims for bodily injury or property damage caused by your business. Additionally, property insurance covers your business assets, such as equipment, inventory, and buildings, in case of fire, theft, or other covered events.

Home Insurance Guide: If you operate your business from home, it’s essential to understand how your homeowner’s insurance may or may not cover your business activities. In most cases, a standard homeowner’s insurance policy does not provide coverage for business-related losses. Therefore, it is crucial to consider additional business insurance policies to protect your assets and operations.

By investing in the right business insurance policies, you are taking proactive steps to safeguard your company’s financial stability. It is always advisable to consult with an insurance professional who can guide you through the process of understanding your specific insurance needs and finding the most appropriate coverage for your business.

3. Home Insurance Guide

When it comes to protecting your most valuable asset, your home, having the right insurance coverage is crucial. Home insurance provides financial security and peace of mind by safeguarding your property against various risks and unforeseen events. In this section, we will explore the importance of home insurance and highlight key considerations when selecting a policy.

First and foremost, homeowners should understand that home insurance is not just a luxury but a necessity. It serves as a safety net in case of damage caused by natural disasters such as fire, floods, or storms. Additionally, it covers theft or vandalism, providing compensation for any loss or damage to your personal belongings.

To ensure you have adequate coverage, it is essential to assess the value of your property accurately. This includes evaluating the structure itself, as well as any detached structures like garages or sheds. It’s also crucial to take into account the value of your possessions, including furniture, appliances, and electronic devices, as these are protected under most home insurance policies.

Choosing the right insurance provider is equally important. Look for reputable companies that offer comprehensive coverage and have a strong track record in settling claims efficiently. Consider additional factors such as customer service quality and the availability of customizable insurance options.

By investing in the right home insurance policy, you can protect your investment and minimize financial risks associated with potential damages or losses. Evaluate your needs, compare quotes, and select a policy that provides the optimal coverage for your home.

Remember, your home is more than just a physical structure – it represents security and stability for you and your loved ones. Don’t underestimate the significance of home insurance in safeguarding your property and ensuring a worry-free future.

This concludes the section on home insurance. Now you’re equipped with valuable insights that will help you make informed decisions when it comes to protecting your home and its contents.