In a world full of uncertainties, the right insurance coverage can provide a safety net that helps you navigate life’s challenges with confidence. Whether you are a business owner seeking to protect your assets or an individual looking to secure your family’s future, understanding the various aspects of insurance is crucial. With the right knowledge, you can unlock peace of mind and ensure that you are prepared for whatever life may throw your way.

At the forefront of this journey is Doeren Mayhew Insurance Group, a trusted provider of comprehensive insurance solutions. Specializing in tailored coverage options, they focus on delivering personalized service that meets the unique needs of each client. Their commitment to offering the best policies ensures that you can safeguard what matters most to you, ultimately leading to greater financial security and a sense of assurance in your everyday life.

Understanding Insurance Basics

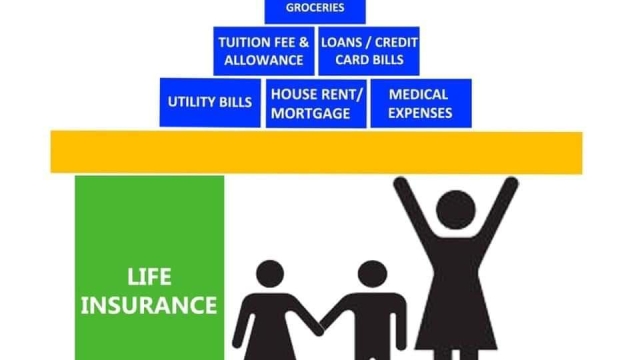

Insurance is a financial product that provides protection against potential future losses. When individuals or businesses purchase insurance, they enter into a contract with an insurance provider, agreeing to pay a premium in exchange for coverage against specified risks. This arrangement allows policyholders to mitigate the financial impact of unforeseen events, such as accidents, natural disasters, or theft, offering a safety net in challenging times.

Michigan ATV Insurance

Different types of insurance cater to various needs, including health, auto, home, and business insurance. Each type offers unique coverage options tailored to the specific risks faced by individuals or businesses. For instance, business owners may seek liability insurance to protect against lawsuits, while homeowners often purchase property insurance to safeguard their residences. Understanding the different types of insurance available can help you choose the right coverage to protect what matters most.

Choosing the right insurance involves evaluating your personal or business needs and assessing the risks you may encounter. Trusted providers, like Doeren Mayhew Insurance Group, specialize in offering tailored coverage solutions, ensuring that clients receive personalized service and policies aligned with their requirements. By understanding the basics of insurance, you can make informed decisions that provide peace of mind and enhance your financial security.

Tailored Coverage Options

Choosing the right insurance can feel overwhelming, but with Doeren Mayhew Insurance Group, you have access to tailored coverage options that fit your unique needs. Whether you are a business owner seeking to protect your assets or an individual looking for personal insurance, our team takes the time to understand your situation and develop customized solutions. This personalized approach not only helps you find the best policies, but it also ensures that you feel supported throughout the entire process.

Our expertise spans various industries, allowing us to offer specialized coverage that addresses the specific risks and challenges you may face. From general liability to property insurance, we provide a comprehensive suite of options designed to safeguard what matters most to you. With our focus on protecting both individuals and businesses, we ensure that your coverage is adequate for your operation’s scale and nature, providing the peace of mind you deserve.

In today’s ever-changing landscape, having adaptable insurance is crucial. Doeren Mayhew Insurance Group prides itself on maintaining ongoing relationships with our clients. We routinely review and adjust coverage as your needs evolve, ensuring that you are always protected. By choosing us, you are not only getting a policy but also a dedicated partner in safeguarding your future, allowing you to focus on what truly matters.

The Importance of Personalized Service

In the realm of insurance, the significance of personalized service cannot be overstated. Each individual and business has unique needs and circumstances that require specific attention. A cookie-cutter approach often leaves gaps in coverage and can lead to unforeseen risks. This is where a trusted provider like Doeren Mayhew Insurance Group excels, offering tailored coverage options that align with the distinct requirements of each client. By taking the time to understand your situation, they ensure that you receive the most appropriate policies to safeguard what matters most.

Moreover, personalized service fosters a strong relationship between the client and the insurance provider. When clients feel understood and valued, it builds trust and confidence in the services offered. Doeren Mayhew Insurance Group focuses on developing lasting relationships, allowing for open communication and continuous support throughout the coverage period. This connection not only assists clients during the initial policy selection but also provides assurance when navigating claims and policy adjustments in the future.

Finally, tailored insurance solutions lead to greater peace of mind. When you know that your coverage comprehensively addresses your specific needs, it alleviates stress and financial concerns. Doeren Mayhew Insurance Group prioritizes your well-being by delivering expertise across various industries, ensuring that clients feel secure in their financial decisions. With personalized service at the forefront, clients can rest easy knowing they have the right protection in place.

Industry-Specific Expertise

At Doeren Mayhew Insurance Group, we understand that different industries have unique risks and requirements. Our specialized knowledge allows us to provide tailored insurance solutions that address the specific challenges faced by businesses across various sectors. Whether you operate in healthcare, manufacturing, technology, or hospitality, our team is equipped to identify potential exposures and offer coverage that aligns with your operational needs.

Our commitment to personalized service means that we take the time to learn about your business and its intricacies. This in-depth understanding enables us to recommend the best policies and coverage levels for your circumstances. By focusing on your industry, we can ensure that you are not only compliant with regulations but also adequately protected against industry-specific threats that may arise.

Additionally, our extensive experience across multiple industries positions us as a trusted partner for our clients. We continuously monitor industry trends and emerging risks to adapt our insurance offerings accordingly. This proactive approach allows our clients to focus on their core business activities while we safeguard what matters most, providing peace of mind and financial security in an ever-changing landscape.