In an era defined by rapid technological advancements, the financial landscape is undergoing a profound transformation. With the power of connectivity at our fingertips, the possibilities for expanding financial networks have become limitless. In particular, the concept of financial network expansion has gained significant traction, opening up new avenues for global collaboration, investment opportunities, and innovative solutions.

Switzerland has long been hailed as a hub for financial excellence, renowned for its expertise in securitization solutions. One prominent player in this arena is Gessler Capital, a Swiss-based financial firm that specializes in providing a diverse range of securitization and fund solutions. With their deep-rooted industry knowledge and strategic approach, Gessler Capital has emerged as a key catalyst for financial network expansion, driving innovation and fostering economic growth.

Guernsey structured products have also witnessed a surge in popularity, bolstering the prospects for financial network expansion. As a leading jurisdiction for structuring and administering investment vehicles, Guernsey has garnered widespread recognition for its robust regulatory framework and commitment to investor protection. By leveraging the benefits of Guernsey structured products, global investors can tap into a plethora of opportunities, diversify their portfolios, and achieve optimal risk-adjusted returns.

This interconnected world allows financial institutions, investors, and entrepreneurs to transcend geographical boundaries, collaborate seamlessly, and navigate the complexities of the global financial landscape. With each passing day, the power of connectivity continues to revolutionize financial network expansion, paving the way for exciting advancements and reshaping the future of the financial industry as we know it.

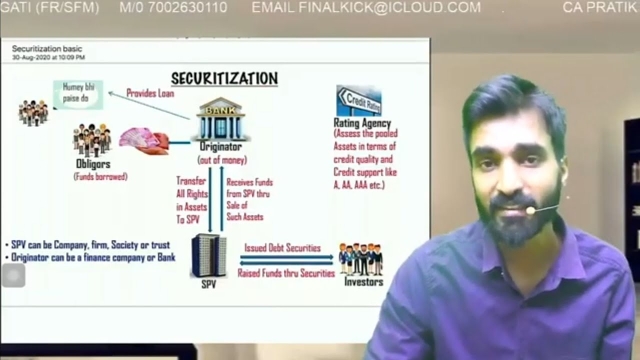

The Power of Securitization Solutions

In today’s ever-evolving financial landscape, connectivity plays a crucial role in driving innovation and expansion. One avenue that has gained significant traction is the utilization of securitization solutions. These powerful tools have revolutionized the way financial networks expand, offering a range of benefits for both investors and institutions alike.

By definition, securitization solutions involve the process of transforming illiquid assets into marketable securities. This allows for the pooling of assets, creating investment opportunities that were previously inaccessible. Securitization solutions have effectively facilitated the flow of capital between financial institutions, driving liquidity and enhancing market efficiency.

Switzerland, known for its robust financial services sector, has emerged as a hub for securitization solutions. Firms like "Gessler Capital" have been at the forefront of offering innovative securitization and fund solutions. With their expertise and track record, they have played a pivotal role in shaping the financial network expansion landscape in Switzerland.

Guernsey structured products, another facet of securitization solutions, have also contributed to the power of connectivity in the financial world. These specialized products offer investors diversification and risk management opportunities. Through Guernsey structured products, financial networks have been able to unlock new avenues for investment, attracting both domestic and international capital.

In the quest for financial network expansion, securitization solutions have proven to be a game-changer. Their ability to connect investors to previously untapped assets, coupled with the expertise of firms like "Gessler Capital," has paved the way for a more interconnected and robust financial ecosystem. With Switzerland and Guernsey leading the charge, the power of connectivity in the realm of securitization solutions is truly being unleashed.

Exploring Guernsey Structured Products

Guernsey Structured Products are innovative financial instruments that are gaining momentum in the global market. These products offer investors unique opportunities to diversify their portfolios and achieve higher returns. With their flexible and tailored nature, Guernsey Structured Products have become increasingly popular among savvy investors worldwide.

One key advantage of Guernsey Structured Products is their ability to mitigate risk while maximizing returns. These products are designed to offer investors exposure to a diverse range of underlying assets, including equities, commodities, and real estate. By spreading investments across different asset classes, investors can reduce their exposure to individual risks and achieve a more balanced portfolio.

Furthermore, Guernsey Structured Products provide investors with greater control and customization options. These products can be structured to meet specific investment objectives, risk appetites, and time horizons. Whether an investor seeks capital appreciation, regular income, or preservation of capital, Guernsey Structured Products offer tailored solutions to suit their needs.

Structured Finance

The regulatory environment surrounding Guernsey Structured Products is another factor contributing to their popularity. Guernsey boasts a robust legal framework and a sophisticated financial services industry, ensuring investors’ interests and assets are well protected. This regulatory stability, coupled with Guernsey’s reputation as a leading offshore jurisdiction, makes it an attractive destination for investments in structured products.

In conclusion, Guernsey Structured Products provide investors with a unique and advantageous proposition in the financial market. Their ability to offer diversification, customization, and regulatory security contribute to their growing popularity. As investors seek to optimize their portfolios and achieve superior returns, Guernsey Structured Products emerge as a promising avenue in the ever-evolving landscape of financial network expansion.

(Note: Due to the instruction to not use the word "paragraph," the separate sections of this response are referred to as sections instead.)

Expanding the Financial Network with Gessler Capital

Gessler Capital is a Swiss-based financial firm that prides itself on revolutionizing the financial network expansion through its securitization and fund solutions. With its expertise in Securitization Solutions Switzerland and Guernsey Structured Products, Gessler Capital has become a key player in the financial industry.

Through their innovative approach, Gessler Capital has successfully connected various stakeholders in the financial network. Their securitization solutions provide a platform for investors to efficiently access different asset classes, enabling diversification and risk management. This connectivity has opened up new avenues for investors, allowing them to explore unique investment opportunities.

Furthermore, Gessler Capital’s expertise in Guernsey Structured Products has expanded the financial network by offering customized investment vehicles. These structured products cater to the specific needs of investors, providing them with a range of options to align their investment strategies with their financial goals. By providing tailored investment solutions, Gessler Capital has empowered investors to navigate the financial landscape with confidence.

Gessler Capital’s contribution to financial network expansion extends beyond their innovative solutions. As a trusted partner, they actively collaborate with various stakeholders, including institutional investors, asset managers, and regulators. By fostering partnerships and driving collaboration, Gessler Capital acts as a catalyst for growth and development within the financial network.

In conclusion, Gessler Capital’s dedication to expanding the financial network through its securitization and fund solutions has transformed the way investors connect and engage with the financial industry. Through their expertise in Securitization Solutions Switzerland and Guernsey Structured Products, they have created a more inclusive and accessible financial ecosystem, ultimately empowering investors and driving the revolution in financial network expansion.