The banking industry has witnessed a remarkable transformation in recent years, as banking automation takes center stage. With the advent of advanced technologies, traditional banking practices have evolved, and automated solutions have become integral to financial institutions worldwide. This shift towards automation is revolutionizing the way banking operations are conducted and is offering numerous benefits to both customers and banks themselves.

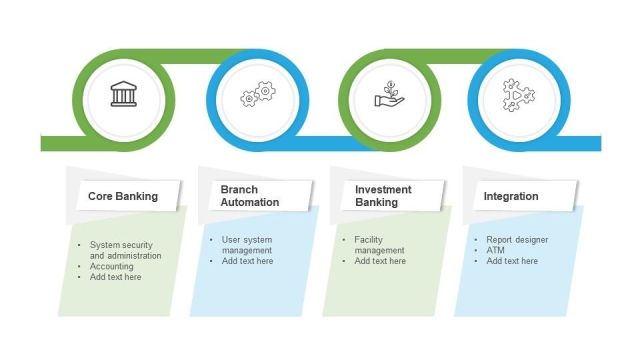

Banking automation encompasses a wide range of practices, from customer service interactions to internal processes, all aimed at streamlining operations and improving efficiency. By leveraging artificial intelligence and machine learning algorithms, banks can now automate tasks that were once labor-intensive, allowing employees to focus on more complex and value-added activities. Additionally, customers are benefiting from enhanced convenience with the availability of online banking, mobile applications, and ATM services, making banking accessible 24/7 from the comfort of their own homes.

Furthermore, the adoption of banking automation solutions provides significant advantages in terms of accuracy and compliance. These systems ensure consistent and error-free transactions, reducing the risk of human error that could lead to monetary losses or regulatory issues. With stricter regulations and increased scrutiny in the financial sector, automation helps banks meet compliance requirements and maintain the highest levels of security.

In this comprehensive guide, we will delve deeper into the world of banking automation. We will explore the various aspects of automation in banking, examining the key technologies driving this transformation and the benefits they bring. Whether you are a banking professional seeking to understand the latest industry trends or a customer curious about how automation affects your financial experiences, this guide aims to provide valuable insights and help navigate the increasingly automated landscape of the banking industry. So, join us in uncovering the rise of robo-banking and the exciting journey of banking automation.

The Benefits of Robo-Banking

Robo-banking, also known as banking automation, is transforming the banking industry in numerous ways. This technology-driven approach offers a wide range of benefits for both financial institutions and their customers.

Increased Efficiency: Robo-banking streamlines various banking processes, eliminating the need for manual intervention and reducing the potential for human errors. By automating routine tasks such as data entry, transaction processing, and account management, banks can significantly improve their operational efficiency while minimizing the possibility of errors or delays.

Enhanced Customer Experience: Automation in banking simplifies and accelerates customer interactions, providing a seamless and user-friendly experience. With robo-banking solutions, customers can access their accounts anytime, anywhere, and carry out transactions conveniently through online platforms and mobile applications. This 24/7 accessibility enhances customer satisfaction and loyalty, as it eliminates the need to visit physical bank branches or adhere to traditional working hours.

Advanced Data Analysis: Another significant advantage of robo-banking is its ability to analyze vast amounts of data in real-time. By leveraging automation and artificial intelligence, banks can efficiently process and interpret customer data to gain valuable insights. This analysis enables banks to better understand their customers’ preferences, personalize services, and offer targeted financial solutions that meet individual needs. Additionally, through automated risk assessment and fraud detection systems, robo-banking can enhance security measures and protect customers from potential financial threats.

Robo-banking is undoubtedly playing a pivotal role in revolutionizing the banking industry. Its efficiency, improved customer experience, and advanced data analysis capabilities are reshaping the way financial institutions operate and cater to their customers’ evolving needs.

2. Automated Solutions for Enhanced Efficiency

Automation has become a game-changer in the banking industry, revolutionizing the way financial institutions operate. With the advent of advanced technologies, banks now have access to a wide range of automated solutions that enhance their efficiency and streamline their processes.

One such solution is automated customer service. Traditional banking involved lengthy phone calls and in-person visits to resolve customer queries and issues. However, with the rise of robo-banking, customers can now enjoy the convenience of instant assistance through chatbots and virtual assistants. These AI-powered tools can accurately address customer queries, provide personalized recommendations, and even perform basic transactions, all in a matter of seconds.

Another area where automation has made significant strides is in transaction processing. Previously, manual entry of transaction data was not only time-consuming but also prone to human errors. Today, with automated solutions, banks can process large volumes of transactions swiftly and accurately. Advanced algorithms and machine learning techniques enable the automation of repetitive tasks such as data entry, reconciliation, and fraud detection, freeing up valuable time for banking professionals to focus on more complex and strategic activities.

Moreover, automated risk management solutions have become essential for banks in today’s fast-paced digital landscape. With the increasing complexity of financial regulations and the growing threat of cybercrime, banks need robust systems that can identify and mitigate risks effectively. Automation tools can continuously monitor transactions, flag suspicious activities, and trigger alerts in real-time, helping banking institutions stay ahead of potential threats and comply with regulatory requirements.

In conclusion, automation has brought significant advancements to the banking industry, offering solutions that enhance efficiency and streamline operations. From customer service to transaction processing and risk management, automated technologies are revolutionizing the way banks function. By adopting these solutions, financial institutions can not only improve their productivity but also deliver seamless banking experiences to their customers.

3. Addressing Concerns and Outlook for the Future

Automation in the banking industry has undoubtedly brought numerous benefits, but it is not without its concerns. One of the main worries revolves around job displacement. As more tasks are automated, there is a concern that traditional banking roles may become obsolete. However, it is important to note that while certain job functions may be replaced by machines, new roles will emerge in areas such as programming, data analytics, and customer experience management. The key lies in upskilling and reskilling the existing workforce to adapt to these changes.

Digital Lending

Another concern is the issue of security. As banking processes become more automated, there is a fear that sensitive customer data may be at a higher risk of cyberattacks. To address this, banks are heavily investing in advanced security measures and protocols. These include robust encryption techniques, multi-factor authentication, and real-time fraud detection systems. By constantly evolving their security infrastructure, banks strive to stay one step ahead of cybercriminals and ensure the safety of their customers’ financial information.

Looking ahead, the future of banking automation appears promising. With advancements in artificial intelligence and machine learning, automation solutions will continue to evolve, providing more sophisticated capabilities. We can expect to see enhanced personalized banking experiences, where customers are served with tailored financial recommendations and insights based on their individual preferences and needs. Additionally, automation will enable faster and more accurate credit approvals, streamlining the lending process for both individuals and businesses.

In conclusion, while there are valid concerns surrounding banking automation, it is important to recognize the potential it holds for the industry. By addressing these concerns head-on and embracing the possibilities of automation, banks can revolutionize how they operate and deliver improved services to their customers. The future of banking automation is bright, and it will continue to redefine the landscape of the industry in the years to come.