Owning a home is not just about having a place to live. It’s a haven, a sanctuary where your memories are formed and cherished. However, with owning a home comes the responsibility of protecting it from unexpected events that could potentially disrupt your haven. This is where home insurance steps in, providing you with peace of mind and financial security should the unexpected occur.

Home insurance is more than just a standard policy; it’s a comprehensive package tailored to safeguard not only your physical dwelling but also your personal belongings. It covers a wide range of risks, ranging from natural disasters and accidents to theft and vandalism. By ensuring that you have the appropriate home insurance coverage, you can rest easy knowing that your haven is shielded from potential financial burdens.

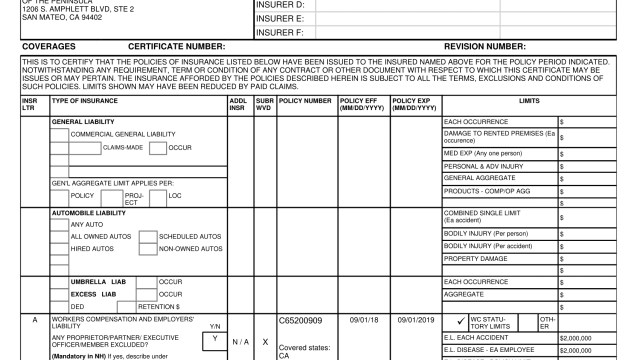

In addition to the protection offered by home insurance, it’s also essential to consider specialized insurance policies such as workers comp insurance, general liability insurance, and contractor insurance. These specific policies are designed to address the unique risks associated with owning a home, especially when it comes to renovations or hiring contractors. Workers comp insurance provides coverage for any injuries sustained by workers on your property, while general liability insurance offers protection against accidental damage caused by contractors or other third parties. Contractor insurance, on the other hand, is crucial when you take on home improvement projects, ensuring that both you and the contractor are adequately covered during the construction process.

Remember, your haven deserves the utmost protection. By understanding the importance of home insurance and considering specialized policies such as workers comp insurance, general liability insurance, and contractor insurance, you can ensure that your home remains the safe and secure haven you envision. So, take the necessary steps to safeguard your dwelling today and enjoy the peace of mind that comes with knowing you are protected no matter what.

Understanding Home Insurance

Home insurance plays a crucial role in safeguarding your haven from unforeseen risks and potential financial burdens. It provides protection for your dwelling and personal belongings, ensuring that you can recover and rebuild in the event of damage or loss.

One important aspect of home insurance is coverage for liability. This safeguards you against potential legal and financial liabilities if someone is injured on your property. Whether it’s a slip and fall accident or a dog bite, liability coverage can help protect your finances and provide peace of mind.

Additionally, home insurance typically covers damage caused by perils such as fire, theft, vandalism, and natural disasters. This means that if your home or belongings are damaged due to any of these events, your insurance policy can provide the necessary funds for repairs or replacements.

However, it’s important to note that not all risks and perils are covered by standard home insurance policies. It’s essential to carefully review the terms and conditions of your insurance policy to understand the specific coverage you have. Consider any additional coverage options you may need, such as flood insurance or earthquake insurance, depending on your geographic location and potential risks.

By understanding the ins and outs of home insurance, you can ensure that your haven is adequately protected against unforeseen circumstances. Taking the time to review and evaluate your policy can provide you with the peace of mind that comes from knowing you are well-prepared and protected.

Importance of Workers Comp Insurance

Workers Comp Insurance is an essential component of home insurance. It provides important protection for both homeowners and their workers. Accidents can happen anytime, and having workers comp insurance ensures that your employees are covered in case of any work-related injuries or illnesses.

Without workers comp insurance, homeowners could be financially responsible for medical bills, lost wages, and even legal expenses resulting from workplace accidents. In many cases, the cost of these claims can be substantial and could potentially have a significant impact on the homeowner’s financial stability.

By having workers comp insurance, homeowners can safeguard themselves from potential lawsuits and financial liabilities. This type of insurance also helps create a safer work environment, as it encourages homeowners and contractors to prioritize safety measures to prevent accidents from happening in the first place.

Having workers comp insurance also promotes trust and professionalism in the contracting industry. When homeowners hire contractors who have this insurance coverage, they can have peace of mind knowing that any injuries or accidents that may occur during the project will be properly addressed.

In summary, workers comp insurance is a crucial aspect of home insurance. It protects homeowners from potential financial burdens resulting from workplace accidents, promotes a safer work environment, and builds trust between contractors and homeowners.

Benefits of General Liability Insurance

General Liability Insurance provides essential protection for homeowners by covering them against financial loss due to property damage, bodily injury, or personal injury claims. This type of insurance is designed to safeguard your haven from unexpected accidents or mishaps that can occur on your property.

One of the primary benefits of General Liability Insurance is that it offers coverage for property damage caused by accidents or negligence. Suppose a guest accidentally knocks over an expensive vase in your living room, resulting in its damage. In this case, General Liability Insurance can help cover the cost of repairs or replacement, ensuring that you don’t have to bear the financial burden on your own.

Another valuable aspect of General Liability Insurance is its coverage for bodily injury claims. Accidents can happen at any time, and if someone sustains an injury while visiting your home, you could potentially face a lawsuit. However, with General Liability Insurance, you can have peace of mind knowing that medical expenses and legal fees associated with such claims may be covered.

Commercial Auto Insurance

General Liability Insurance also provides protection against personal injury claims. These claims may arise if someone alleges that they were harmed due to defamation, invasion of privacy, or wrongful eviction, to name a few examples. Having this coverage in place can help to mitigate potential legal and financial consequences from such claims, allowing you to focus on maintaining the safety and security of your home.

In conclusion, General Liability Insurance offers homeowners a crucial safety net by providing coverage for property damage, bodily injury, and personal injury claims. By taking steps to protect your haven through this type of insurance, you can ensure that unexpected accidents or legal disputes don’t jeopardize your financial well-being or the tranquility of your home.