As the world of cryptocurrency continues to gain traction, new avenues for trading and investment are emerging at a remarkable pace. Among these are proprietary trading firms, which offer a unique way for traders to engage in the crypto market with the firm’s capital. This opens up opportunities for both seasoned investors and newcomers alike to explore the potential of digital currencies in a structured and supportive environment.

One firm making waves in this space is mycryptofunding. By leveraging advanced trading strategies and providing traders with the necessary resources, mycryptofunding enables individuals to navigate the complexities of crypto trading with confidence. The firm’s focus on education, risk management, and cutting-edge technology positions it as a valuable player in the rapidly evolving landscape of cryptocurrency trading.

What is a Crypto Prop Trading Firm?

A crypto prop trading firm is a financial institution that uses its own capital to trade cryptocurrencies in the market. Unlike traditional investment firms that manage external client funds, these firms take on the risks and rewards of trading with their own money. This structure allows them to be more flexible and aggressive in their trading strategies, often focusing on short-term gains in the volatile crypto environment.

At the core of a crypto prop trading firm is a team of skilled traders and analysts who utilize various strategies to maximize profits. These firms often employ sophisticated algorithms and trading technologies to analyze market trends and execute trades efficiently. The goal is to generate significant returns on investment by capitalizing on the rapid price movements typical of the cryptocurrency markets.

For those interested in trading without using their own capital, joining a crypto prop firm can be an attractive option. Many firms provide training, support, and a share of the profits, allowing traders to leverage the firm’s resources to enhance their trading skills. MyCryptoFunding, for instance, offers a model where traders can access substantial capital while sharing in the profits they generate, fostering an environment of growth and learning in the crypto trading landscape.

The Role of MyCryptoFunding in the Market

MyCryptoFunding plays a significant role in the evolving landscape of cryptocurrency trading by providing essential resources and capital to traders without requiring them to risk their own funds. This unique business model allows traders to access the cryptocurrency market with the backing of a prop trading firm, enabling them to focus on strategy and execution. The firm’s capital allocation strategy is designed to empower skilled traders, helping them maximize their potential earnings while minimizing personal financial exposure.

The firm further enhances its influence in the market by offering a robust framework of support services, including training, mentorship, and cutting-edge trading tools. This support is crucial for traders who are looking to refine their skills and navigate the complexities of cryptocurrency volatility. By fostering a community of knowledgeable traders, MyCryptoFunding not only contributes to individual success but also promotes a more informed trading environment across the entire cryptocurrency sphere.

Moreover, MyCryptoFunding actively participates in the broader market dynamics by encouraging responsible trading practices and risk management strategies. This commitment to ethical trading helps mitigate some of the market’s inherent risks, allowing traders to engage in a more sustainable manner. As a result, the firm not only boosts its traders’ performance but also positively impacts the overall reputation and stability of the cryptocurrency market.

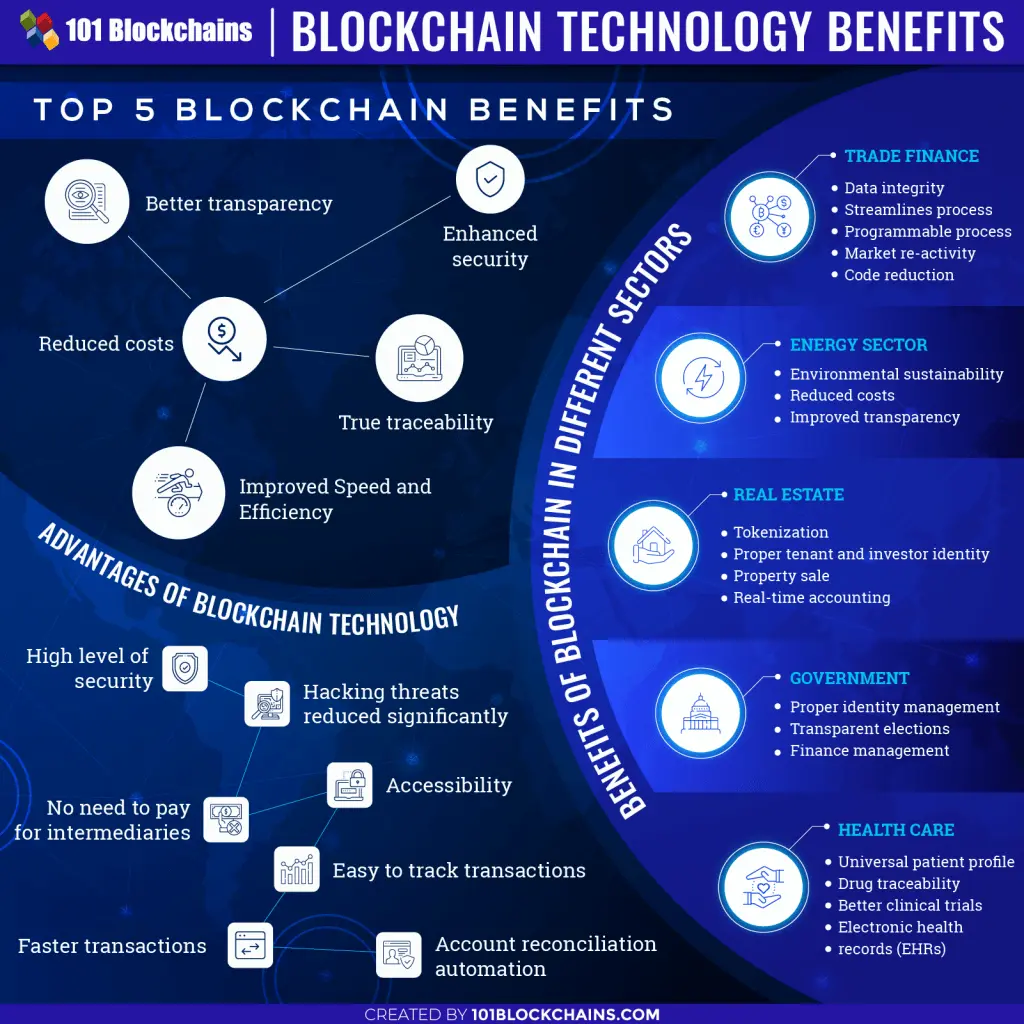

Benefits of Trading with a Prop Firm

Trading with a prop firm offers significant advantages for both novice and experienced traders. One of the most notable benefits is the access to substantial capital. Unlike trading with personal funds, which can limit the ability to take larger positions, prop firms provide their traders with the necessary funds to maximize potential profits. This capital leverage allows traders to explore various strategies without the risk of depleting their personal resources.

Another essential benefit is the professional training and support provided by prop firms. Many firms like MyCryptoFunding offer educational resources, mentorship programs, and a collaborative trading environment. This support system can be invaluable for traders looking to hone their skills, as they can learn from seasoned professionals and gain insights into market dynamics. Such resources empower traders to develop more effective strategies and improve their overall trading performance.

Finally, trading with a prop firm can lead to reduced emotional stress associated with trading. By eliminating the pressure of trading with personal capital, traders can focus on their strategies and decision-making processes more clearly. This environment encourages a methodical approach to trading, as professionals at prop firms often adopt risk management practices that help mitigate potential losses. As a result, traders can engage with crypto markets more confidently and strategically.

Risks and Challenges in Crypto Prop Trading

Crypto prop trading, while offering exciting opportunities for profit, comes with inherent risks that traders must navigate. The volatility of cryptocurrencies means that prices can fluctuate dramatically within short periods, leading to significant financial losses. These unpredictable price movements can catch even the most seasoned traders off guard, making risk management strategies essential for sustaining operations in a prop trading environment.

Another challenge faced by crypto prop firms is the regulatory landscape, which is continuously evolving. Different jurisdictions have varying rules regarding cryptocurrency trading, and firms must remain compliant to avoid penalties or operational shutdowns. The uncertainty surrounding regulations can also affect market sentiment, leading to sudden drops in trading volume and liquidity, which can further complicate trading strategies and exit plans.

Lastly, cybersecurity threats pose a significant risk to crypto prop trading firms. With hackers frequently targeting exchanges and trading platforms, the potential for theft or loss of funds is a constant concern. Firms need to invest in robust security measures to protect their assets and trader information. Failure to do so could result in devastating losses that undermine the firm’s credibility and operational integrity.

Success Stories from MyCryptoFunding

MyCryptoFunding has made a significant impact in the crypto trading space, with numerous success stories showcasing the potential of its model. Many traders who joined the firm have transformed their initial investments into substantial gains through strategic trading and expert mentorship. One notable example is a novice trader who, after just six months with MyCryptoFunding, turned a modest investment into a six-figure profit. This success was achieved through the firm’s rigorous training programs and access to advanced trading tools, demonstrating the effectiveness of their approach.

Another inspiring story comes from a team of traders who pooled their resources within MyCryptoFunding and collaborated to develop unique trading strategies. Their collective efforts led to the identification of profitable trading opportunities in emerging cryptocurrencies. Within a year, they consistently outperformed the market averages, earning recognition within the broader trading community. Their success not only enhanced their financial stability but also established them as thought leaders in the crypto trading sphere.

Lastly, MyCryptoFunding has fostered an inclusive environment that has enabled traders from diverse backgrounds to thrive. A former teacher found her passion for crypto trading through the firm’s supportive workshops and community events. By applying her analytical skills to trading strategies, she achieved impressive results and discovered a new career path. This transformation not only changed her financial status but also inspired others in her community to explore the possibilities within the world of cryptocurrency trading.

Funded Forex Trading

The Future of Crypto Prop Trading

As the cryptocurrency market continues to evolve, the future of crypto prop trading firms like mycryptofunding is poised for remarkable growth. These firms are increasingly adopting advanced technologies and data analytics to enhance trading strategies and improve risk management. This evolution allows traders to make more informed decisions, capitalizing on the volatility of the crypto market while minimizing potential losses. The integration of artificial intelligence and machine learning will further pave the way for innovative trading methodologies, attracting both novice and seasoned traders looking for a competitive edge.

Moreover, regulatory developments will play a significant role in shaping the future of crypto prop trading. As governments around the world establish clearer guidelines for cryptocurrency trading, firms that prioritize compliance and transparency will likely gain a competitive advantage. This shift could foster greater trust and adoption within the market, attracting institutional investors who have historically been cautious about engaging with cryptocurrencies. The ability of firms like mycryptofunding to adapt to regulatory changes will be crucial for their long-term sustainability and growth.

Lastly, the growing interest in decentralized finance and the broader blockchain ecosystem will create new opportunities for crypto prop trading firms. As decentralized exchanges and innovative financial products emerge, traders will have access to a wider array of investment opportunities. Firms that can effectively navigate these new landscapes while leveraging their expertise in traditional and digital asset markets will be best positioned to thrive. The future of crypto prop trading looks promising, with ample potential for those ready to embrace change and innovation.